Solar's 'Threat' to Utilities Prompts Financial Rating Downgrade

It's that embarrassing thing where a major financial firm tells you your industrial sector might not survive if we save the planet. A team of analysts at Barclays, the dreadnought British bank and financial services firm, downgraded its rating for the American utilities sector this week due to perceived threat to the industry from residential rooftop solar with battery storage.

The move will make it more expensive for American power companies to obtain loans, especially if other analysts follow suit.

And it's all because the Barclays boffins figure that it will soon be cheaper to generate and store your own power than it will be to pay your electric bill as usual.

The 324-year-old London-based financial firm, the world's seventh-largest bank, dropped its rating of American electrical utilities to "underweight" from "market weight." An "underweight" rating is intended to suggest to investors that they consider whether they might own too much of a particular stock, a more nicely worded version of the old "sell" rating being phased out by investment analysts.

It's not news that the price of solar panels has been dropping precipitously over the last decade. As long as the sun shines, using that power is already cheaper in much of the United States, with the costs of equipment and installation amortized over the life of the panels, than buying power from your local utility.

That cheaper electricity from solar has driven a huge amount of growth in solar leasing and net metering. The problem for property owners seeking to become energy independent is that the sun sets, and then they need to use power from the grid to keep their lights on and refrigerator running.

But as it turns out, the price of battery storage suitable for residential-scale applications has also dropped dramatically. According to Rob Wile at Business Insider, a local battery bank for a household that cost $17,000 in 2009 costs just $3,700 now, largely due to the increase in electric car manufacturing.

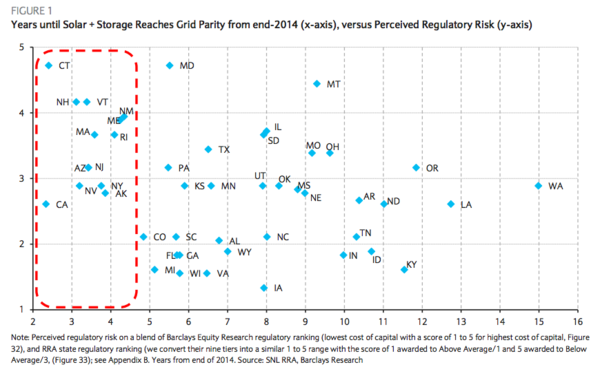

Barclays' analysts project that solar-plus-storage systems could become cheaper than grid power in California by 2017, and in the rest of the country well before 2030. (The state of Washington, with its super-cheap hydroelectric power, will be the last holdout.)

Barclays' assessment of utilities' mid-term future is relatively bleak, with escalating costs of grid power making solar and storage more attractive to an increasing number of ratepayers. Or maybe that should be former ratepayers.

Of course, Barclays isn't the only firm that sees this coming. The utilities do as well, hence the recent flurry of attempts nationwide to tax, disincentivize, or otherwise undermine home solar and storage. But the British bank thinks those attempts will ultimately fail:

We fully expect utilities and regulators to make a good faith effort to preserve the status quo "regulatory compact," whereby the monopoly utility provides a safe and reliable service and regulators allow it to earn a reasonable low-risk return. However, we also expect them to be playing a constant game of catch-up as solar develops. The costs of solar and storage technologies are falling quickly and may fall even faster as higher demand builds additional scale. But the cost of distribution grids and thermally generated power are more likely to rise than to fall, in our view. As a result, regulators and utilities will be constantly trying to respond to a moving target, which is precisely the environment where slow-moving incumbents can fall behind.

In other words, the 20th century monopoly utility business model may be a necessary casualty of a sane climate policy. it depends how soon America's power companies see the handwriting on the wall -- and in their bond ratings -- and change course on distributed solar with storage.