SoCal Housing Market: A Tale of Two Cities

Very few things captivate Southern Californians like the topic of real estate. California has lived through previous housing bubbles but nothing like the size of the current housing boom and bust. Let us look at a few key points. The median price for a home in Southern California in February of 2000 was $197,000. At the peak of the housing bubble, a Southern California home was going for $505,000. The current median price? Try $247,000.

Yet the current median price is deceptive because the current market is dominated by foreclosure resales which tend to sell at the lower end of the market. For the month of April 53 percent of all homes sold in the Southland were foreclosure resales. The majority of the market is made up of distress sales. This may be the confusing part for many would be buyers that are looking to purchase homes in more prime locations and realize that prices have not come down as much as they had imagined. We hear about the 50 percent median price drop for the region yet some areas have seen only 5, 10, or even 15 percent price drops. What gives?"¨ "¨

The Southern California market is unique in many aspects. First, we are looking at a total of six counties with over 20 million people. There is nothing homogenous about the market. You have two counties in Riverside and San Bernardino that have seen drastic price cuts. These areas now have median prices of $180,000 and $138,500 respectively. Riverside at the peak of the market had a median price of $423,000 and San Bernardino reached a peak price of $380,000. A 57 and 63 percent decline is going to get your attention and that is why there is so much devastation hitting the Inland Empire. Yet with such a big cut in prices, many investors and first time buyers are jumping back into the market. "¨ "¨

Riverside County has seen sales jump by 40 percent on a year over year basis. San Bernardino has seen an astonishing jump in sales coming in at 87 percent higher on a year over year basis. But if we look at a few other areas like Orange County, sales are up by 10 percent from last year. Ventura County actually has seen a drop in sales by 6 percent. So what’s the story?Lower priced homes are dominating the sales.

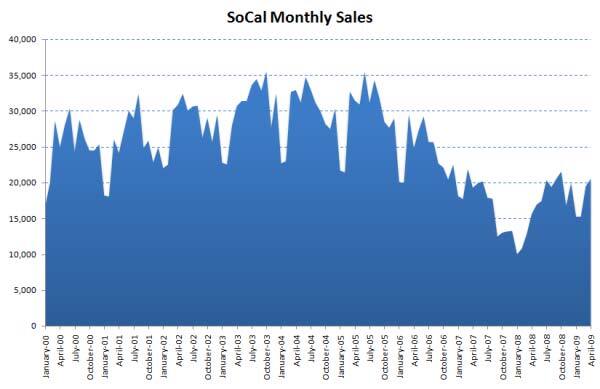

The biggest sales month in Southern California occurred in October of 2003 and we had over 35,000 homes sell. The low came in January of 2008 when only 9,983 homes sold. For perspective, this was the first sub-10,000 month in the entire decade. So looking at last month’s sales data and seeing 20,000 homes sell in the Southland may seem like a big jump but put into context and factoring that over half of the homes are foreclosure resales, this number may not seem so big. We have to also keep in mind that during the bubble having 30,000 sales a month was not uncommon. How many months did we have 30,000 plus sales in the Southland during the decade? 30.

Let us look at a few cities in Los Angeles County to highlight this point further. If we look at Cerritos, a middle-class city in the county the median price of a home has only fallen by 4 percent from last year. Why? The city has excellent schools and people are still willing to pay that price. Culver City, another desirable location in the Westside has seen prices drop by 17 percent. Many buyers hear about the 50 percent price cuts and apply this to these more select areas and find that prices have modestly come down. This doesn’t mean that prices will not come down further in these areas. Many of the middle to upper priced areas are loaded with Alt-A mortgages, loans made to more supposedly creditworthy borrowers but not quite prime borrowers, and these loans are starting to show signs of significant weakness.

Notice of defaults are also jumping in these areas. The thing many buyers and sellers may find confusing is that once these areas start moving larger amounts of inventory, we will see the overall median price move up for the Southland. How is that? Take for example a city with a current median price of $500,000. They sold 10 homes at this price point. Later this year, the median price drops to $450,000 and 20 homes sell at this price. The median price is more concerned with volume and right now the volume is at the low end of the market.

Case and point? Cerritos saw 15 sales in April with a 4 percent price drop. One zip code in Palmdale with a median price of $97,000 and a 47 percent year over year drop saw 202 sales in April. That is the difference right now. The vast amount of sales are occurring at the lower end of the market. Jumbo loans, those mortgages that are over $417,000 made up 40 percent of Southland sales before August of 2007 when the credit crisis hit. In April jumbo loans made up slightly above 10 percent of all sales. With homes moving at the lower end of the market and higher priced homes stalling, the Southland is seeing a tale of two cities.