This is a Terrible Way to Make Laws

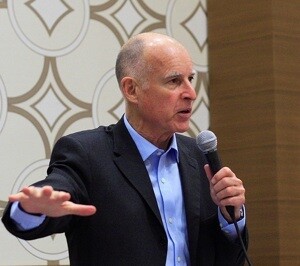

As readers know, an epic ballot initiative battle is brewing. On one side of the ring we have the Chief Executive Officer of the most populous state in the nation, Governor Jerry Brown. On the other side we have a Pasadena-based, Harvard-educated attorney and daughter of billionaire Charles Munger, Molly Munger. Both are supporting ballot initiatives that would raise taxes.

Their proposals are different, but their overall goal of raising revenue is the same, and many fear that with two proposals on the ballot it is more likely that both measures will fail. Others worry that voters could be confused by the differences and/or similarities between the measures.

Thus Munger has been under enormous pressure to drop her proposal, something she has not done. In fact, she is now suing because of the placement that Brown's proposal is slated to get on the November 2012 ballot.

Brown recently signed a bill that means constitutional amendments, like his proposal, will be listed near the top of the ballot, pushing Munger's, a statute, down to a less desirable location.

The takeaway here should go beyond the seemingly endless struggle between Brown and Munger. The point is that as a state we should truly take another hard look at the ballot initiative process. Can this really be the best way to make laws?

If conventional wisdom dictates that voters will throw up their hands and vote "no" if more than one tax initiative is on the same ballot, then that tells us something deeply unsettling about the process. Similarly, if the placement on a single ballot is considered to be a large factor in the success or failure or a proposal, then that seems problematic as well.

Lawmaking should be a deliberative process. It should not depend so heavily on the number of proposals in one broad area, and the order of those proposals on the ballot. I'm not saying that deliberation is the name of the game in the Legislature, but discussion and reflection seems to happen even more rarely with regard to ballot initiatives.

When it comes to questions as important as how we will be taxed and how we will fund public education and other vitally important programs and services, we should strive for more than jockeying over the position on the ballot.

Related: 3 New Tax Measures Have Qualified for November Ballot

Jessica Levinson writes about the intersection of law and government every Monday. She is a Visiting Professor at Loyola Law School. Read more of her posts here.